×

Tahiti Pack

Categories

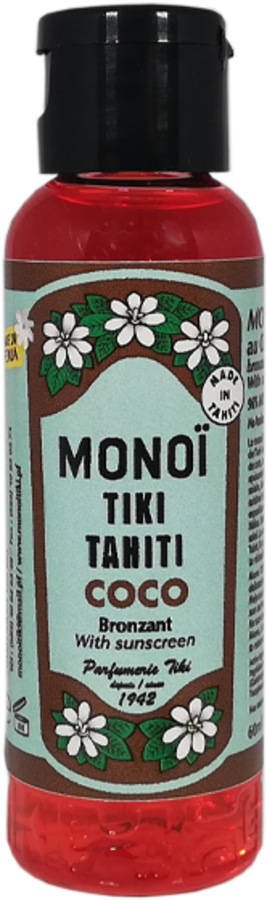

- Monoi de Tahiti Oil (66)

- Tamanu (12)

- Coconut (24)

- Tahiti Vanilla (26)

- Beauty (78)

- Hinano (41)

- Delicatessen (72)

- Calendar and diary (6)

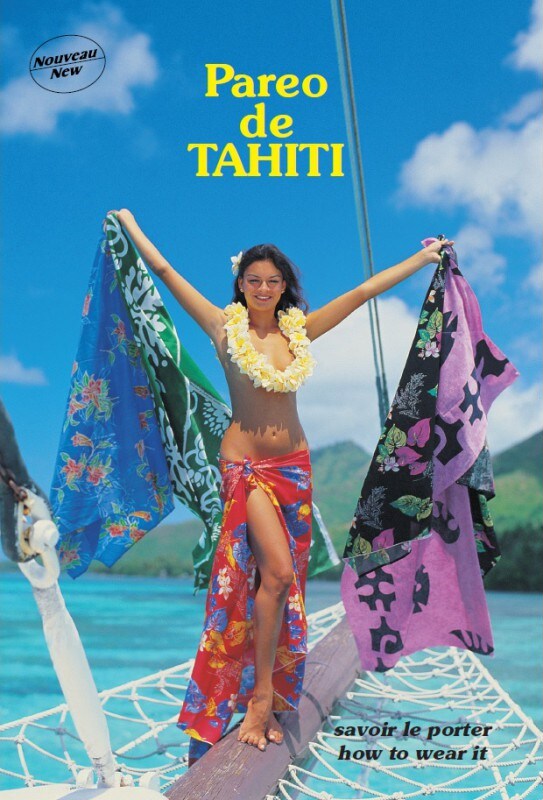

- Tahitian costumes (29)

- Interior Decoration (22)

- Bags, Jewel and Accessories (33)

- Textile (27)

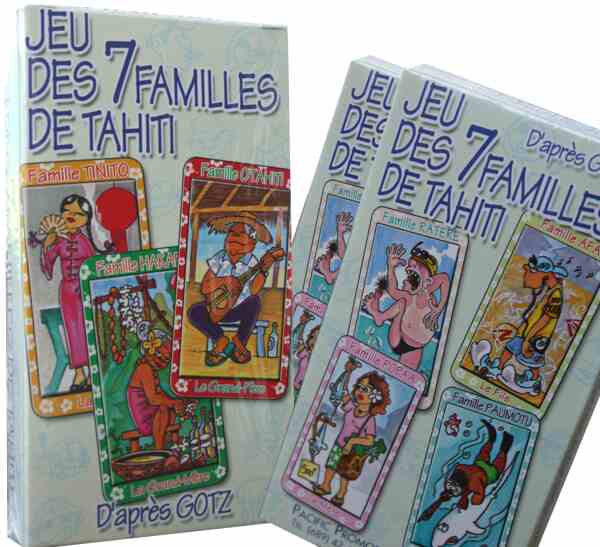

- Leisure (17)

- Our Box (12)

- Special offer

- Whats's News?

- Information

- Return and refund

- Contact us

Tahiti: Monday 23 June, 2025 - 02:10

-

-

EUR

US Dollar (USD)Euro (EUR)Franc Pacifique (XPF)Yen (JPY)Pound sterling (GBP)Canadian dollar (CAD)Rand (ZAR)Indian rupee (INR)Singapore dollar (SGD)Australian dollar (AUD)New Zealand dollar (NZD)Franc Suisse (CHF)Peso Mexicano (MXN)Philippine peso (PHP)Indonesian rupiah (IDR)Peso Chileno (CLP)Swedish krona (SEK)Polish złoty (PLN)

-